December 16, 2025

Your 2026 Planning Guide: What’s on the Horizon

By Elliot Palabe, CFP®

Introduction

As we close out 2025, now is the time to look ahead and prepare your financial plan for the coming year. Several important changes are on the horizon in 2026 — from retirement plan enhancements to updates in retirement income rules and estate strategies — that can influence how you save, spend, and structure your financial goals.

This guide highlights key developments likely to impact your plan and offers practical considerations to help you start 2026 in a strong position.

1. Social Security Benefit and Eligibility Updates

In 2026, Social Security beneficiaries will receive a cost-of-living adjustment (COLA) of approximately 2.8 %, designed to help benefits keep pace with inflation, resulting in modest monthly increases beginning in January.¹

Other updates include higher earnings thresholds and increases in the maximum amount of income subject to Social Security payroll tax, reflecting adjustments in wage bases for the year ahead.¹

What this means for you:

- Modest Social Security income increases in 2026.

- More earnings are subject to Social Security taxation (see below for Social Security Wage Base).

2. Enhanced Retirement Savings Opportunities

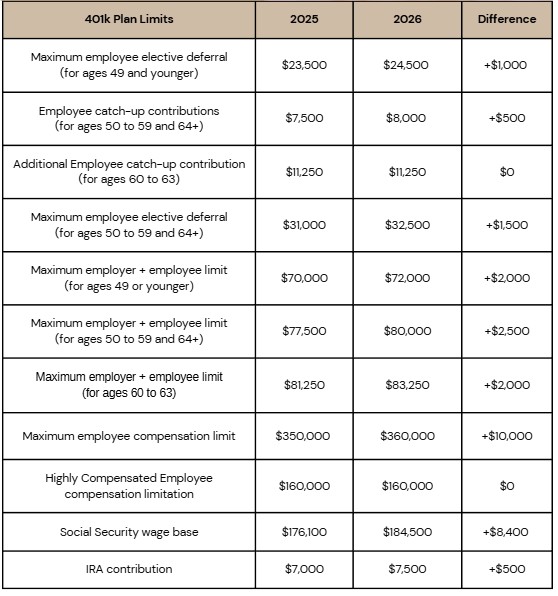

The IRS periodically adjusts contribution limits for retirement accounts to reflect inflation, and 2026 is no exception. Election and catch-up contribution limits increase, giving you more room to save on a tax-advantaged basis.²

- 401(k), 403(b), and 457 plans: Standard contribution limits will rise to $24,500 (from $23,500), and catch-up limits for those age 50 and over increase as well (see below).

- IRA contributions: The annual limit rises to $7,500 for 2026.

- New SECURE 2.0 catch-up rule for employer sponsored plans: Catch-up contributions must be treated as Roth for those earning more that $150,000 in the prior year beginning in 2026.²

What this means for you:

- Higher limits give you more opportunity to boost retirement savings.

- Review your contribution elections now to take full advantage of the updated limits.

Full list of 2026 Limit Adjustments:

3. IRS Inflation-Adjusted Benefits and Thresholds

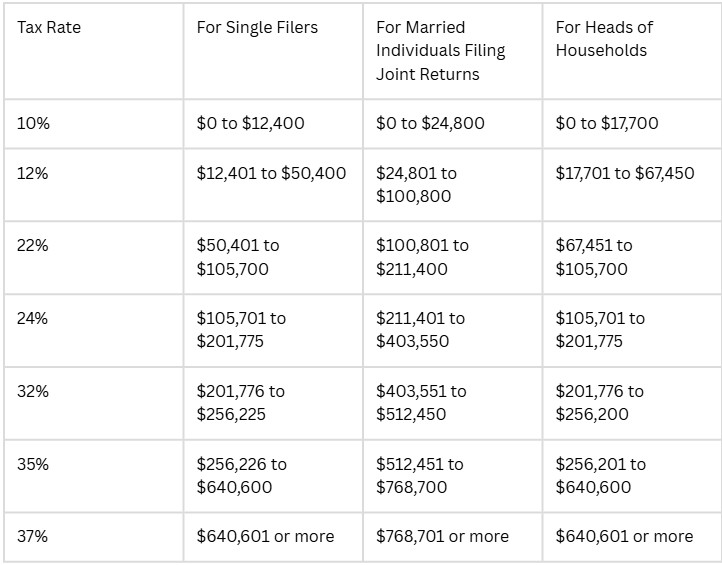

Each year, the IRS adjusts several tax-related figures — including deductions, credits, and tax bracket thresholds — to help protect taxpayers from “bracket creep” as incomes rise with inflation. These inflation adjustments, which take effect for the 2026 tax year and are reflected in the thresholds used when filing returns in 2027, will affect your projected cash flow and planning.³

What this means for you:

- Updating your withholding or estimated tax strategy now can help you better align your tax position with expected income and deductions in 2026.

- These adjustments may subtly affect your planning around taxable investments and distributions.

2026 Ordinary Income Tax Brackets:

4. Evolving Retirement Distribution Rules

Changes under the SECURE 2.0 Act continue to reshape retirement distribution requirements. For example, the age for Required Minimum Distributions (RMDs) is currently 73, giving many retirees more flexibility before withdrawals are mandated. This age will increase to 75 in 2033. Other provisions reduce penalties for missed RMDs and eliminate RMDs for qualified Roth 401(k) accounts, aligning them with Roth IRAs.⁴

What this means for you:

- You may have additional flexibility in timing withdrawals, which can impact tax planning in retirement.

- Coordinating distribution timing with income needs and tax brackets can help preserve long-term savings.

5. Estate Planning & Inherited Retirement Account Rules

How retirement accounts are passed to heirs continues to evolve and remains a crucial planning consideration. Under current rules, most non-spouse beneficiaries must fully withdraw inherited retirement accounts within 10 years of the original owner’s death. Eligible designated beneficiaries (such as spouses and certain dependents) may have additional flexibility under the law.⁴

What this means for you:

- Reviewing how retirement accounts interact with your estate plan is essential to help manage potential tax consequences.

What This Means for Your Financial Plan

As 2026 approaches, thoughtful planning involves anticipating changes in retirement income, savings limits, and estate rules. Key takeaways include:

- Reassess retirement income and RMD timing to reflect updated distribution rules and age thresholds.

- Take advantage of higher savings limits for retirement accounts.

- Update withholding and estimated tax strategies in light of inflation-adjusted thresholds.

At Palabe Wealth, we help clients integrate these evolving rules into comprehensive financial plans so you can move into the new year with confidence.

Schedule a 15-minute introductory phone call by contacting us directly at (847) 249-6600.

References

- Social Security Administration — 2026 cost-of-living adjustment and benefit/eligibility updates.

- IRS notice — 2026 retirement plan contribution limit adjustments.

- IRS publication — inflation adjustments affecting thresholds and limits for the 2026 tax year.

- Retirement system legislative framework — SECURE 2.0 Act provisions affecting RMDs and beneficiary rules.

- Tax Foundation – 2026 Tax Brackets

Disclosures

This material is provided for general informational purposes and is not intended to be specific financial, investment, tax, or legal advice. Consult your tax advisor, financial professional, or attorney regarding your individual situation. Investing and planning involve risk, including potential loss of principal.

Securities and advisory services offered through LPL Financial, a registered investment advisor and member FINRA/SIPC. Palabe Wealth and LPL Financial are separate entities. (26-LPL)

Elliot Palabe, CFP®

Elliot Palabe is a Wealth Advisor at Palabe Wealth, where he plays a pivotal role in designing comprehensive retirement plans and working directly with clients to address their financial needs. Elliot's expertise lies in his ability to combine personalized Financial Planning with strategic Tax Planning, helping to ensure that each client's financial strategy is both optimized and aligned with their individual goals and circumstances.

Elliot has a solid educational foundation that underpins his professional acumen, as he holds a Bachelor’s degree in Finance from the Foster College of Business at Bradley University. His academic background has provided him with a deep understanding of financial markets, investment strategies, and economic principles.

Elliot is a CERTIFIED FINANCIAL PLANNER™ professional. He holds several critical financial industry licenses, including the Series 65, 63, 6, and SIE, held through LPL Financial. These qualifications enable him to offer comprehensive investment guidance and demonstrate his thorough knowledge of the financial services industry.

A specialist in the use of sophisticated financial planning and tax planning software, Elliot brings a technological edge to his approach. This expertise allows him to create detailed and highly personalized financial plans that can adapt to changing market conditions and tax environments. By leveraging cutting-edge technology, Elliot ensures that Palabe Wealth's clients receive the most accurate, up-to-date, and effective financial advice possible.

His work is instrumental in helping clients navigate the complexities of financial planning and retirement preparation, helping to ensure they are well-positioned to pursue their long-term financial objectives.

Outside of work, Elliot competes in pickleball. The game’s blend of strategy and precision reflects the same qualities he brings to financial advising - thoughtful planning, attention to detail, and focus.